Rich dad poor dad summary

Introduction

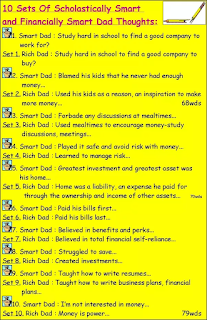

Robert Kiyosaki introduces the context, says that his poor dad went to Stanford and earned a PhD, and his rich dad never finished the eighth grade. Having two dads advising him so differently regarding money turned out to be very valuable for Robert Kiyosaki and made him think more in the long run. Then, he goes on to explain more differences between his both dads and their attitude regarding money. Kiyosaki chose to listen to and learn from his rich dad, who taught him 6 lessons over five years, described in the next chapters.

Chapter 1: The rich don’t work for money

At a very young age, Robert Kiyosaki had his first business partner, his schoolmate Mike. They worked for Mike’s dad, who taught them lessons on how to make money. The first rule they learn was that the rich don’t work hard for money, their money works hard for them. The first thing Mike’s dad did was to pay Robert and Mike 10 cents/hr so that they could see what is like to get a salary they find short – and imagine how would that be if multiplied over the time-span of 50 years. Then, rich dad had them working for free, which taught them two lessons: 1) most people are guided by fear (of not being able to pay for their bills) or desire (e.g. greed) and 2) we need to think of alternatives to make money, which Robert and Mike did – at a very a young age they set up a small library room, where they provided leftover magazines to other kids for a small fee.

Chapter 2: Why teach financial literacy?

Kiyosaki makes an analogy between retirement and a tree: if you water it for a few years, at some point it doesn’t need to be watered anymore, because its roots are deep in enough. Kiyosaki teaches lesson 2, which is why to be financially educated. He argues that, first, its important because of the ups and downs of the market (page #59). In page #61, he explains how he and Mike learned it from the rich dad. Then, he goes on to explain rule #1, which he considers the foundation of a good financial literacy: the definition of an asset and a liability. Although simple, this is a very profound concept. He also introduces cash-flow diagrams which are useful to understand the concepts, but basically, it explains how to filter between assets and liabilities. In page #70, he provides a list of assets. Kiyosaki also argues that not only cash flow tells the story of how a person handles money, but how more money can actually be a problem to many people. He provides the example of his poor dad, who considered his house to be his biggest investment, and how it is to be trapped in the rat race: people buy expensive houses which they pay for 30 years and use a bill consolidation loan to pay off their credit cards (page #74).

The story of this couple keeps repeating: as a result of their income increasing, they buy their dream home, and a new car. Soon they find themselves trapped in the rat race. All to often, the middle class lets the power of money to control them. Kiyosaki argues that people simply lack financial education. For instance, the decision of owning a house in lieu of an investment portfolio results in loss of time, additional capital and education (page #83). The chapter then explains that the rich get richer because they acquire assets and the middle class struggles because they increase their liabilities. Some analogies are made: income means working for a company and the government (since it gets its share before you see it) and owning a house means working for the bank (pages #89 and #90).

Chapter 3: Mind your business

Kiyosaki starts off by explaining the difference between each one’s profession and business. At school, we learn how to work for somebody else for the rest of our lives. Rich people focus on assets, the masses focus on their income, and that is why they are always asking for a promotion or raise. This leads to financial struggle. Kiyosaki recommends you to keep your job and build your asset column; keep your expenses low, reduce liabilities and buy assets. Think of your dollars as employees – they work 24/7 for you without complaining. Build this list first, afford some luxuries after.

Chapter 4: The history of taxes and the power of corporations

Kiyosaki explains that in the beginning there was no taxes and government created taxes to punish the rich and give to the poor. The rich are smart, the middle class ends up paying way more than the rich. In particular, rich use corporations to pay fewer taxes, as they are very effective at reducing the tax burden. Knowledge is power. Money should work for you, not the other way around: don’t give the power to the government or your employer. There is a link to the previous chapter of minding your business. Kiyosaki says that working for Xerox Corp. was essential for him to build his RE holding, which payed for his Porsche. Stresses the importance of financial IQ again (pages 116-120).

Chapter 5: The rich invent money

Kiyosaki starts by emphasizing that fear often suppresses genius in people. As a teacher for financial education, he often fosters his students to take risks. At this point, you may have the question of why to improve your financial IQ. Kiyosaki argues that only you can answer that question. However, we live in astonishingly fast-changing times, and people are often caught off guard, or “pushed around” as Kiyosaki says. They often blame the economy or their boss, and only seldom they consider that the problem is actually them.

Kiyosaki uses CASHFLOW, a game he created, to teach investment to make a series of other points. First, some people playing it can see the game reflecting them. This is good because they can quickly learn what is causing them to struggle. Some people playing the game gain lots of money but don’t know what to do with it. Others claim that “the right cards” are not coming to them, and they just sit there, waiting. Some get the right opportunity but they don’t have the money. Some get the opportunity, have the money but don’t know what to do. And all this comes down to the meaning of having financial IQ, which really means having more options.

After this, Kiyosaki shows a series of deals he did himself, buying-and-selling Real Estate and increasing his asset columns, showing a practical example of what financial intelligence brought him. Then, on page 138, he summarizes financial intelligence as being a set of 4 skills: accounting, investing, understanding markets and law. In page 148, two kinds of investors are defined, those that buy packaged investments, and those that put investments together, and Robert Kiyosaki says that the latter are the more professional investor and his rich dad encouraged him to be. To be this kind of investor, you need to find opportunities that other investors missed, know how to raise capital and organize smart people. There is always risk, learn to manage it instead of avoiding it.

Chapter 6: Work to learn, don’t work for money

This chapter is primarily about the benefit of learning new skills, showing how trapped one become when we are too specialized. The chapter starts off with an example that Robert Kiyosaki when himself through. He interviewed by a journalist who was an excellent writer but didn’t do well in selling her books, so Kiyosaki advised her to take sales-training courses. He generalizes this problem, stating that many talented people struggle financially because they only master one skill.

Kiyosaki provides a few examples of his own journey. First, he says that he entitled his first book “If You Want to Be Rich & Happy Don’t Go to School” on purpose; not because he is against education, but because he knew that title would take him to more TV and radio shows, and sell more. Then, he goes on to explain that he kept changing jobs to learn more skills, and skills that became important for him to succeed. He joined Xerox Corp because he was a shy person, and Xerox has one of the best sales-training programs in America. While his rich dad was proud of him, his poor dad was more disappointed at every job change. To other people, Robert Kiyosaki recommends to join a marketing company as a second job, or join a union if they are too specialized and refuse to widen their skills.

One of the examples that is provided is that, although most his students claim to cook a better hamburger than fast food chains, the fast food chains make way more money than his students. He uses examples of other people who are not doing so well financially, mostly due to their lack of knowledge of business. He also says that people who run major companies are usually transferred between departments within the company till they get to the top, to acquire knowledge in all areas of business. In page 168, Kiyosaki summarizes the main management skills needed to succeed: cash flow, systems, and people, while the most important specialized skills are sales and marketing. One of the analogies made with specialized people being vulnerable is an athlete who becomes injured or too old to play. Finally, Kiyosaki remembers the importance of giving, in order to get.

Chapter 7: Overcoming obstacles

This chapter starts with a bold claim: “the primary difference between a rich person and a poor person is how they manage fear”. Once people become financially educated, they still face some obstacles to become rich. In particular, Robert Kiyosaki enumerates 5 obstacles: 1) fear, 2) cynicism, 3) laziness, 4) bad habits and 5) arrogance. Robert Kiyosaki explores all these obstacles, one by one. Regarding fear, Kiyosaki says that everyone fears to lose money. Rich dad recommended Kiyosaki to think like a Texan when it comes to fearing losing money: they think big, and they’re proud when they win and brag when they lose. Rich dad also said that the greatest reason for lack of financial success was playing too safe. “People are so afraid of losing that they lose”, rich dad said. Kiyosaki leaves another bold claim: “for most people, the reason they don’t win financially is because the pain of losing money is far greater than the joy of being rich”. In essence, they play not to lose, not to win. Balanced portfolios are fine if you have to lose, but make sure you start early.

The second obstacle is cynicism. Kiyosaki uses the story of the Chicken Little to illustrate that we all have doubts, or noise, as Kiyosaki calls it. It can come from within or for the outside. A savvy investor has to know how to make money even in bad times. Kiyosaki tells the story of a friend who backed out on a deal Kiyosaki and his wife had arranged. Another example is tax-lien certificates, which Kiyosaki keeps a portion of his money in, and people often evaluate as “risky” even without investing in them. As rich dad said, “cynics never win”. They criticize, and winners analyze. At the end of this section, a motivational story is provided: Colonel Sanders lost his business at age 66 and started to live off a Social Security check. He went around the country and over more than a thousand rejections, he finally became a multi-millionaire, after selling his fried chicken recipe.

A “little greed” is the solution to laziness, the third obstacle. Although we are raised thinking of greed as bad, as Kiyosaki reports, that greed is what really makes us tend laziness off. Again, he relates this greed with the reactions of both dads to Kiyosaki’s asks, when he was younger. While the poor dad use to say “I can’t afford it”, rich dad use to say “how can I afford it?”, opening up possibilities and excitement. When Kiyosaki wanted to quick the rat race, he questioned himself and thought about how would his life be if he didn’t have to work again. Our lives are a reflection of our habits more than our education. An example of a good habit preached by the rich dad was to pay himself first, and bills last. This motivated him to deliver: if he could not pay his creditors, he was forced to find additional sources of income.

Arrogance is the last obstacle. Rich dad lost money whenever he was arrogant. People are arrogant to hide ignorance. If you’re arrogant in a subject, start educating yourself by finding an expert or reading a book.

Chapter 8: Getting started

This chapter lists 10 things to start improving your financial life. First, find a reason to succeed. Kiyosaki mentions the example of a young woman who had dreams of swimming for the US Olympic team. She used to wake up very early to practice, among many other sacrifices she used to go through. She said it was due to love because she did that for herself and the people she loved. Two, make good daily choices. Kiyosaki explains that we have the power of choosing what we want. He takes courses, listens to CDs and what not. Essentially, he invests a lot in his financial education, which he considers crucial to succeed. Arrogance, on the other hand, impedes you from listening and learning and will get you nowhere. Three, choose friends carefully. Be friends with people you can learn from, don’t listen to the Chicken Littles. If possible, get access to legal insider trading.

Four, master a formula and learn quickly. Kiyosaki explains that in a fast-changing world, it’s often not what you know, but how quickly you can learn that makes the difference. Five, pay yourself first and master self-discipline. Kiyosaki argues that self-discipline is the biggest difference between the rich and the poor. Six, pay your brokers well. In general, Kiyosaki argues that you’ll have a better service (aka make more money) if you do pay them well. If you cut on their commissions – why would they want to help you?

Seven, be an Indian giver: ask yourself how quickly you get your money back. Look at the ROI, but not only that. They also look at what you get for free in deals too. Eight, use assets to buy luxuries. When you desire something, use your assets to pay for it. If you get $10.000 as a gift, you can either use that money to make more money and pay for what you want, or you can get yourself into further debt if you use that as a down-payment for something else. Nine, have your own heroes, people who inspire you. It will make investing a lot easier. The latest advice is about the power of giving: teach and you should receive.

Introduction

Robert Kiyosaki introduces the context, says that his poor dad went to Stanford and earned a PhD, and his rich dad never finished the eighth grade. Having two dads advising him so differently regarding money turned out to be very valuable for Robert Kiyosaki and made him think more in the long run. Then, he goes on to explain more differences between his both dads and their attitude regarding money. Kiyosaki chose to listen to and learn from his rich dad, who taught him 6 lessons over five years, described in the next chapters.

Chapter 1: The rich don’t work for money

At a very young age, Robert Kiyosaki had his first business partner, his schoolmate Mike. They worked for Mike’s dad, who taught them lessons on how to make money. The first rule they learn was that the rich don’t work hard for money, their money works hard for them. The first thing Mike’s dad did was to pay Robert and Mike 10 cents/hr so that they could see what is like to get a salary they find short – and imagine how would that be if multiplied over the time-span of 50 years. Then, rich dad had them working for free, which taught them two lessons: 1) most people are guided by fear (of not being able to pay for their bills) or desire (e.g. greed) and 2) we need to think of alternatives to make money, which Robert and Mike did – at a very a young age they set up a small library room, where they provided leftover magazines to other kids for a small fee.

Chapter 2: Why teach financial literacy?

Kiyosaki makes an analogy between retirement and a tree: if you water it for a few years, at some point it doesn’t need to be watered anymore, because its roots are deep in enough. Kiyosaki teaches lesson 2, which is why to be financially educated. He argues that, first, its important because of the ups and downs of the market (page #59). In page #61, he explains how he and Mike learned it from the rich dad. Then, he goes on to explain rule #1, which he considers the foundation of a good financial literacy: the definition of an asset and a liability. Although simple, this is a very profound concept. He also introduces cash-flow diagrams which are useful to understand the concepts, but basically, it explains how to filter between assets and liabilities. In page #70, he provides a list of assets. Kiyosaki also argues that not only cash flow tells the story of how a person handles money, but how more money can actually be a problem to many people. He provides the example of his poor dad, who considered his house to be his biggest investment, and how it is to be trapped in the rat race: people buy expensive houses which they pay for 30 years and use a bill consolidation loan to pay off their credit cards (page #74).

The story of this couple keeps repeating: as a result of their income increasing, they buy their dream home, and a new car. Soon they find themselves trapped in the rat race. All to often, the middle class lets the power of money to control them. Kiyosaki argues that people simply lack financial education. For instance, the decision of owning a house in lieu of an investment portfolio results in loss of time, additional capital and education (page #83). The chapter then explains that the rich get richer because they acquire assets and the middle class struggles because they increase their liabilities. Some analogies are made: income means working for a company and the government (since it gets its share before you see it) and owning a house means working for the bank (pages #89 and #90).

Chapter 3: Mind your business

Kiyosaki starts off by explaining the difference between each one’s profession and business. At school, we learn how to work for somebody else for the rest of our lives. Rich people focus on assets, the masses focus on their income, and that is why they are always asking for a promotion or raise. This leads to financial struggle. Kiyosaki recommends you to keep your job and build your asset column; keep your expenses low, reduce liabilities and buy assets. Think of your dollars as employees – they work 24/7 for you without complaining. Build this list first, afford some luxuries after.

Chapter 4: The history of taxes and the power of corporations

Kiyosaki explains that in the beginning there was no taxes and government created taxes to punish the rich and give to the poor. The rich are smart, the middle class ends up paying way more than the rich. In particular, rich use corporations to pay fewer taxes, as they are very effective at reducing the tax burden. Knowledge is power. Money should work for you, not the other way around: don’t give the power to the government or your employer. There is a link to the previous chapter of minding your business. Kiyosaki says that working for Xerox Corp. was essential for him to build his RE holding, which payed for his Porsche. Stresses the importance of financial IQ again (pages 116-120).

Chapter 5: The rich invent money

Kiyosaki starts by emphasizing that fear often suppresses genius in people. As a teacher for financial education, he often fosters his students to take risks. At this point, you may have the question of why to improve your financial IQ. Kiyosaki argues that only you can answer that question. However, we live in astonishingly fast-changing times, and people are often caught off guard, or “pushed around” as Kiyosaki says. They often blame the economy or their boss, and only seldom they consider that the problem is actually them.

Kiyosaki uses CASHFLOW, a game he created, to teach investment to make a series of other points. First, some people playing it can see the game reflecting them. This is good because they can quickly learn what is causing them to struggle. Some people playing the game gain lots of money but don’t know what to do with it. Others claim that “the right cards” are not coming to them, and they just sit there, waiting. Some get the right opportunity but they don’t have the money. Some get the opportunity, have the money but don’t know what to do. And all this comes down to the meaning of having financial IQ, which really means having more options.

After this, Kiyosaki shows a series of deals he did himself, buying-and-selling Real Estate and increasing his asset columns, showing a practical example of what financial intelligence brought him. Then, on page 138, he summarizes financial intelligence as being a set of 4 skills: accounting, investing, understanding markets and law. In page 148, two kinds of investors are defined, those that buy packaged investments, and those that put investments together, and Robert Kiyosaki says that the latter are the more professional investor and his rich dad encouraged him to be. To be this kind of investor, you need to find opportunities that other investors missed, know how to raise capital and organize smart people. There is always risk, learn to manage it instead of avoiding it.

Chapter 6: Work to learn, don’t work for money

This chapter is primarily about the benefit of learning new skills, showing how trapped one become when we are too specialized. The chapter starts off with an example that Robert Kiyosaki when himself through. He interviewed by a journalist who was an excellent writer but didn’t do well in selling her books, so Kiyosaki advised her to take sales-training courses. He generalizes this problem, stating that many talented people struggle financially because they only master one skill.

Kiyosaki provides a few examples of his own journey. First, he says that he entitled his first book “If You Want to Be Rich & Happy Don’t Go to School” on purpose; not because he is against education, but because he knew that title would take him to more TV and radio shows, and sell more. Then, he goes on to explain that he kept changing jobs to learn more skills, and skills that became important for him to succeed. He joined Xerox Corp because he was a shy person, and Xerox has one of the best sales-training programs in America. While his rich dad was proud of him, his poor dad was more disappointed at every job change. To other people, Robert Kiyosaki recommends to join a marketing company as a second job, or join a union if they are too specialized and refuse to widen their skills.

One of the examples that is provided is that, although most his students claim to cook a better hamburger than fast food chains, the fast food chains make way more money than his students. He uses examples of other people who are not doing so well financially, mostly due to their lack of knowledge of business. He also says that people who run major companies are usually transferred between departments within the company till they get to the top, to acquire knowledge in all areas of business. In page 168, Kiyosaki summarizes the main management skills needed to succeed: cash flow, systems, and people, while the most important specialized skills are sales and marketing. One of the analogies made with specialized people being vulnerable is an athlete who becomes injured or too old to play. Finally, Kiyosaki remembers the importance of giving, in order to get.

Chapter 7: Overcoming obstacles

This chapter starts with a bold claim: “the primary difference between a rich person and a poor person is how they manage fear”. Once people become financially educated, they still face some obstacles to become rich. In particular, Robert Kiyosaki enumerates 5 obstacles: 1) fear, 2) cynicism, 3) laziness, 4) bad habits and 5) arrogance. Robert Kiyosaki explores all these obstacles, one by one. Regarding fear, Kiyosaki says that everyone fears to lose money. Rich dad recommended Kiyosaki to think like a Texan when it comes to fearing losing money: they think big, and they’re proud when they win and brag when they lose. Rich dad also said that the greatest reason for lack of financial success was playing too safe. “People are so afraid of losing that they lose”, rich dad said. Kiyosaki leaves another bold claim: “for most people, the reason they don’t win financially is because the pain of losing money is far greater than the joy of being rich”. In essence, they play not to lose, not to win. Balanced portfolios are fine if you have to lose, but make sure you start early.

The second obstacle is cynicism. Kiyosaki uses the story of the Chicken Little to illustrate that we all have doubts, or noise, as Kiyosaki calls it. It can come from within or for the outside. A savvy investor has to know how to make money even in bad times. Kiyosaki tells the story of a friend who backed out on a deal Kiyosaki and his wife had arranged. Another example is tax-lien certificates, which Kiyosaki keeps a portion of his money in, and people often evaluate as “risky” even without investing in them. As rich dad said, “cynics never win”. They criticize, and winners analyze. At the end of this section, a motivational story is provided: Colonel Sanders lost his business at age 66 and started to live off a Social Security check. He went around the country and over more than a thousand rejections, he finally became a multi-millionaire, after selling his fried chicken recipe.

A “little greed” is the solution to laziness, the third obstacle. Although we are raised thinking of greed as bad, as Kiyosaki reports, that greed is what really makes us tend laziness off. Again, he relates this greed with the reactions of both dads to Kiyosaki’s asks, when he was younger. While the poor dad use to say “I can’t afford it”, rich dad use to say “how can I afford it?”, opening up possibilities and excitement. When Kiyosaki wanted to quick the rat race, he questioned himself and thought about how would his life be if he didn’t have to work again. Our lives are a reflection of our habits more than our education. An example of a good habit preached by the rich dad was to pay himself first, and bills last. This motivated him to deliver: if he could not pay his creditors, he was forced to find additional sources of income.

Arrogance is the last obstacle. Rich dad lost money whenever he was arrogant. People are arrogant to hide ignorance. If you’re arrogant in a subject, start educating yourself by finding an expert or reading a book.

Chapter 8: Getting started

This chapter lists 10 things to start improving your financial life. First, find a reason to succeed. Kiyosaki mentions the example of a young woman who had dreams of swimming for the US Olympic team. She used to wake up very early to practice, among many other sacrifices she used to go through. She said it was due to love because she did that for herself and the people she loved. Two, make good daily choices. Kiyosaki explains that we have the power of choosing what we want. He takes courses, listens to CDs and what not. Essentially, he invests a lot in his financial education, which he considers crucial to succeed. Arrogance, on the other hand, impedes you from listening and learning and will get you nowhere. Three, choose friends carefully. Be friends with people you can learn from, don’t listen to the Chicken Littles. If possible, get access to legal insider trading.

Four, master a formula and learn quickly. Kiyosaki explains that in a fast-changing world, it’s often not what you know, but how quickly you can learn that makes the difference. Five, pay yourself first and master self-discipline. Kiyosaki argues that self-discipline is the biggest difference between the rich and the poor. Six, pay your brokers well. In general, Kiyosaki argues that you’ll have a better service (aka make more money) if you do pay them well. If you cut on their commissions – why would they want to help you?

Seven, be an Indian giver: ask yourself how quickly you get your money back. Look at the ROI, but not only that. They also look at what you get for free in deals too. Eight, use assets to buy luxuries. When you desire something, use your assets to pay for it. If you get $10.000 as a gift, you can either use that money to make more money and pay for what you want, or you can get yourself into further debt if you use that as a down-payment for something else. Nine, have your own heroes, people who inspire you. It will make investing a lot easier. The latest advice is about the power of giving: teach and you should receive.